Range Orders

Introduction

This guide will cover how single-side liquidity provisioning can be used to execute Limit Orders on Uniswap V3 Pools. An example to showcase this concept can be found in the Range Order example, in the Uniswap code examples repository. To run this example, check out the guide's README and follow the setup instructions.

This guide builds on top of the Pooling Liquidity guides. We recommend going through this section of the docs before imnplementing Range Orders.

In this example we will create a single-side liquidity position with the NonfungiblePositionManager contract. We will then use ethers JS to observe the price of the Pool on new blocks and withdraw the liquidity when our target is reached.

This guide will cover:

- Understanding Range Orders

- Calculating our Tick Range

- Creating a single-side liquidity position

- Observing the price of the Pool

- Closing the Limit Order

Before working through this guide, consider checking out the Range Orders concept page to understand how Limit orders can be executed with Uniswap V3.

For this guide, the following Uniswap packages are used:

The core code of this guide can be found in range-order.ts.

Understanding Range Orders

If you have read the Range Order Concept page, you can skip this section.

Positions on a V3 Pool are always created with a Tick range in which their liquidity is accessible to swaps on the Pool.

Lets look at the return value of the NonfungiblePositionManager contract when calling the positions function with a Position tokenId.

function positions(

uint256 tokenId

) external view returns (

uint96 nonce,

address operator,

address token0,

address token1,

uint24 fee,

int24 tickLower, // Lower Boundary of Position

int24 tickUpper, // Upper Boundary of Position

uint128 liquidity, // Liquidity

uint256 feeGrowthInside0LastX128,

uint256 feeGrowthInside1LastX128,

uint128 tokensOwed0,

uint128 tokensOwed1

)

We see that a position only stores a single liquidity value, and a tickLower and tickUpper value that define the range in which the liquidity of the Position can be utilised for Swaps.

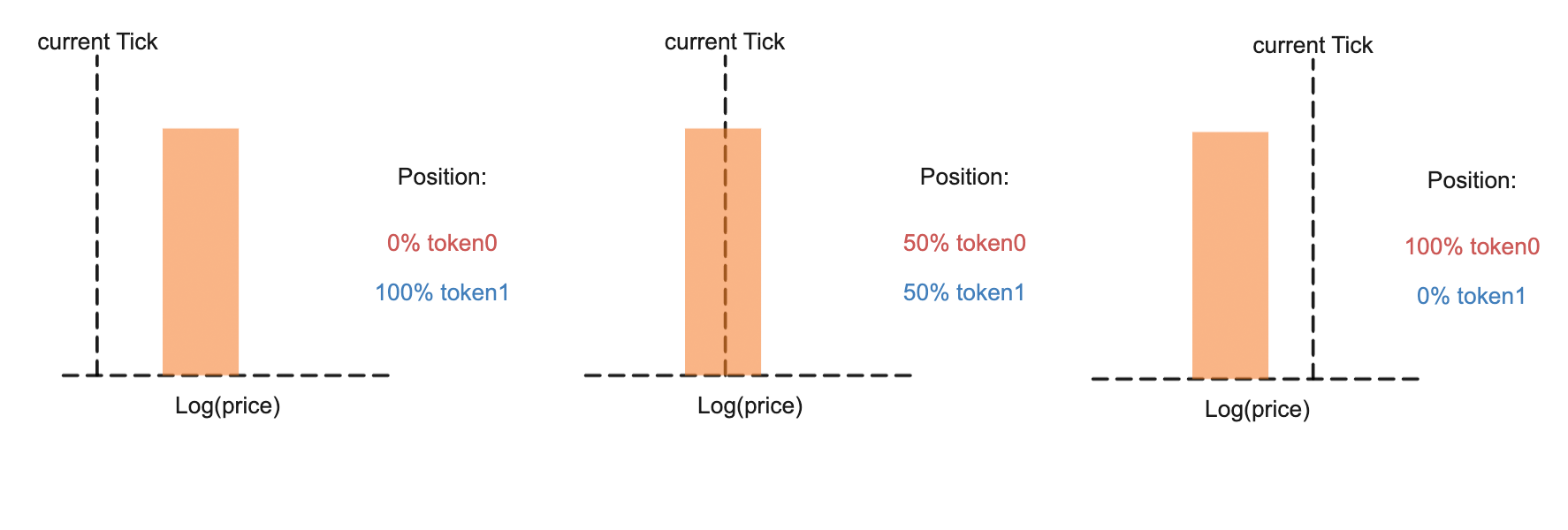

The actual amount of token0 and token1 that a Pool owes the Position owner is calculated from the parts of the liquidity position that are to the left and right of the current Tick.

Liquidity left of the current Tick is denominated in token0 and liquidity right of the current Tick is denominated in token1.

If a new Position is created and the Tick Range of the position does not include the current Tick of the Pool, only one of the two Tokens in the Pool can be provided.

We will call this a Single Side Liquidity Position.

When the current Tick of the Pool moves across the Position, the ratio of token0 and token1 will change, and ultimately inverse if the current Tick moves out of the position on the other side.

We will utilise this behaviour to provide liquidity with token1 and withdraw the position when it has been converted to token0.

Calculating the Tick Range

Our goal for this guide is to create a Take Profit Order that trades token0 for token1 when the Price of token0 increases by 5%.

To create our Position, we need to first decide the Tick Range that we want to provide liquidity in.

Upper Tick

We create a Pool that represents the V3 Pool we are interacting with and get the token0Price.

We won't need full tick data in this example.

import { Pool } from '@uniswap/v3-sdk'

...

const pool = new Pool(token0, token1, fee, sqrtPriceX96, liquidity, tickCurrent)

const currentPrice = pool.token0Price

Next we increase the Price by 5%. We create a new Price with a numerator 5% higher than our current Price:

import { Price, Fraction } from '@uniswap/sdk-core'

const targetFraction = Price.asFraction.multiply(new Fraction(100 + 5, 100))

const targetPrice = new Price(

currentPrice.baseCurrency,

currentPrice.quoteCurrency,

targetFraction.denominator,

targetFraction.numerator

)

Be aware that the numerator and denominator parameters are ordered differently in the Fraction and Price constructor.

We have calculated our target Price but we still need to find the nearest usable tick to create our Position.

As Positions can only start and end at initializable Ticks of the Pool, so we can only create a Range Order to a Price that exactly matches an initializable Tick.

We use the priceToClosestTick function to find the closest tick to our targetPrice.

We then use the nearestUsableTick function to find the closest initializable Tick for the tickSpacing of the Pool.

import {priceToClosestTick, nearestUsableTick} from '@uniswap/v3-sdk'

let targetTick = nearestUsableTick(

priceToClosestTick(targetPrice),

pool.tickSpacing

)

This nearest Tick will most likely not exactly match our Price target.

Depending on our personal preferences we can either err on the higher or lower side of our target by adding or subtracting the tickSpacing if the initializable Tick is lower or higher than the theoretically closest Tick.

Lower Tick

We now find the lower Tick by subtracting the tickSpacing from the upper Tick:

let lowerTick = targetTick - pool.tickSpacing

If the price difference is too low, the lower tick may be left of the current Tick of the Pool. In that case we would not be able to provide single side liquidity. We can either throw an Error or increase our Position by one Tick.

if (tickLower <= pool.tickCurrent) {

tickLower += pool.tickSpacing

targetTick += pool.tickSpacing

}

We now have a lower and upper Tick for our Position, next we need to construct and mint it.

Creating the Single Side Liquidity Position

We will use the NonfungiblePositionManager and Position classes from the v3-sdk to construct our position. We then use an etherJS wallet to mint our Position onchain.

If you are not familiar with liquidity Positions, check out the liquidity position guides.

Minting the Position

We create a Position object with our ticks and the amount of tokens we want to deposit:

import { Position } from '@uniswap/v3-sdk'

const position = Position.fromAmount0({

pool: pool,

tickLower: tickLower,

tickUpper: targetTick,

amount0: amount,

useFullPrecision: true

})

Before we mint our position, we need to give the NonfungiblePositionManager Contract an approval to transfer our tokens.

We can find the Contract address on the official Uniswap GitHub.

For local development, the contract address is the same as the network we are forking from.

So if we are using a local fork of mainnet like described in the Local development guide, the contract address would be the same as on mainnet.

import ethers from 'ethers'

const provider = new ethers.providers.JsonRpcProvider(rpcUrl)

const wallet = new ethers.Wallet(privateKey, provider)

const tokenContract = new ethers.Contract(

pool.token0.address,

ERC20_ABI,

wallet

)

await tokenContract['approve'](

NONFUNGIBLE_POSITION_MANAGER_CONTRACT_ADDRESS,

ethers.BigNumber.from(amount)

)

Once we have our approval, we create the calldata for the Mint call using the NonfungiblePositionManager:

import {MintOptions, NonfungiblePositionManager}

import { Percent } from '@uniswap/sdk-core'

const mintOptions: MintOptions = {

recipient: wallet.address,

deadline: Math.floor(Date.now() / 1000) + 60 * 20,

slippageTolerance: new Percent(50, 10_000),

}

const { calldata, value } = NonfungiblePositionManager.addCallParameters(

order.position,

mintOptions

)

We can populate our mint transaction and send it with our wallet:

const transaction = {

data: calldata,

to: NONFUNGIBLE_POSITION_MANAGER_CONTRACT_ADDRESS,

value: ethers.BigNumber.from(value),

from: address,

maxFeePerGas: MAX_FEE_PER_GAS,

maxPriorityFeePerGas: MAX_PRIORITY_FEE_PER_GAS,

}

const txRes = await wallet.sendTransaction(transaction)

You can find full code examples for these code snippets in range-order.ts.

Getting the tokenId

We want to read the response to our Mint function call to get the position id.

We will need the positionId to fetch the Position Info from the NFTPositionManager contract.

We wait for the transaction receipt and fetch the result using trace_transaction:

let receipt = null

let mintCallOutput

while (receipt === null) {

try {

receipt = await provider.getTransactionReceipt(txRes.hash)

if (receipt === null) {

continue

} else {

const callTraces = await provider.send('trace_transaction', [

txRes.hash

])

mintCallOutput = callTraces[0].result.output

}

} catch (e) {

break

}

}

Your Node provider may not support this call. In that case you can also call the NonfungiblePositionManager Contract with the wallet address and identify the Range Order Position manually:

const mintCallOutput = await wallet.call(transaction)

We get a raw byte string as a return value from this function and have to parse it ourselves. We decode the result with the ethers AbiCoder. The solidity function has this signature:

function mint(

struct INonfungiblePositionManager.MintParams params

) external returns (uint256 tokenId, uint128 liquidity, uint256 amount0, uint256 amount1)

So we need the first parameter to get the tokenId:

const decodedOutput = ethers.utils.defaultAbiCoder.decode(

['tuple(uint256, uint128, uint256, uint256)'],

mintCallOutput

)[0]

const tokenId = decodedOutput.toString()

Ethers handles the string decoding of the byte string we got and parses it to its internal datatypes.

The decodedOutput we get from the AbiCoder is a ethers.Bignumber so we need to cast it to a string to use it with the SDK.

We have created our Range Order Position, now we need to monitor it.

In the code example we use wallet.call to get the position id.

call and trace_call both simulate a transaction on the connected node and return the expected output, trace_call gives us a much more detailed output though.

Depending on the use case, either can be the better choice.

In a production environment you would prefer to wait for the transactionReceipt like described earlier to ensure the transaction was actaully included in the blockchain.

Observing the Price

We need to observe the price of the Pool and withdraw our Position once the tickCurrent has moved across our Position.

We use ethers JS to watch for new blocks and fetch the latest Pool data:

provider.on('block', refreshPool())

function refreshPool() {

... // construct Pool contract

const slot0 = await poolContract.slot0()

const tickCurrent = slot0.tick

}

It is not necessary to calculate the Price from the tick we fetched, as executing the limit order is dependent on the tick range we defined and not the Price from which we calculated it.

if (tickCurrent > targetTick) {

// Withdraw position

}

We check if the tick has crossed our position, and if so we withdraw the Position.

Closing the Limit Order

We call the NonfungiblePositionManager Contract with the tokenId to get all info of our position as we may have gotten fees from trades on the Pool:

import INON_FUNGIBLE_POSITION_MANAGER from '@uniswap/v3-periphery/artifacts/contracts/NonfungiblePositionManager.sol/NonfungiblePositionManager.json'

const positionManagerContract = new ethers.Contract(

NONFUNGIBLE_POSITION_MANAGER_CONTRACT_ADDRESS,

INONFUNGIBLE_POSITION_MANAGER.abi,

provider

)

const positionInfo = await positionManagerContract.positions(tokenId)

We use the NonfungiblePositionManager, the pool, positionInfo and tokenId to create call parameter for a decreaseLiquidity call.

We start with creating CollectOptions:

import { Percent, CurrencyAmount } from '@uniswap/sdk-core'

import { CollectOptions, RemoveLiquidityOptions } from '@uniswap/v3-sdk'

import JSBI from 'jsbi'

const collectOptions: Omit<CollectOptions, 'tokenId'> = {

expectedCurrencyOwed0: CurrencyAmount.fromRawAmount(

pool.token0,

JSBI.BigInt(positionInfo.tokensOwed0.toString())

),

expectedCurrencyOwed1: CurrencyAmount.fromRawAmount(

pool.token1,

JSBI.BigInt(positionInfo.tokensOwed1.toString())

),

recipient: wallet.address,

}

Next we create RemoveLiquidityOptions. We remove all our liquidity so we set liquidityPercentage to 1:

const removeLiquidityOptions: RemoveLiquidityOptions = {

deadline: Math.floor(Date.now() / 1000) + 60 * 20,

slippageTolerance: new Percent(50, 10_000),

tokenId,

// percentage of liquidity to remove

liquidityPercentage: new Percent(1),

collectOptions,

}

We create a new Position object from the updated positionInfo info we fetched:

const updatedPosition = new Position{

pool,

liquidity: JSBI.BigInt(currentPositionInfo.liquidity.toString()),

tickLower: currentPositionInfo.tickLower,

tickUpper: currentPositionInfo.tickUpper,

}

We have everything to create our calldata now and are ready to make our Contract call:

const { calldata, value } = NonfungiblePositionManager.removeCallParameters(

updatedPosition,

removeLiquidityOptions

)

const transaction = {

data: calldata,

to: NONFUNGIBLE_POSITION_MANAGER_CONTRACT_ADDRESS,

value: value,

from: address,

maxFeePerGas: MAX_FEE_PER_GAS,

maxPriorityFeePerGas: MAX_PRIORITY_FEE_PER_GAS,

}

const result = await wallet.sendTransaction(transaction)

Our liquidity position is removed and we receive token1 at the Price we have specified.

We have successfully executed a range order.

Caveats

Executing a range order has certain limitations that may have become obvious during the course of this guide.

- If the price of the Pool drops below

tickUpperwhile we already decided to withdraw our liquidity our order may fail and we either receivetoken0,token0andtoken1or our transaction fails depending on our exact implementation. - Range Orders can only be created between initializable ticks and may not exactly represent our limit order Price-Target.

- Depending on the price ratio of the tokens in the Pool the minimum price difference to the current price may be significant.

- The tokens received are the average between the Price of

tickUpperandtickLowerof the Range order. This can be a significant difference for Pools with a tickCurrent far from 0, for example tokens with different decimals (WETH/ USDT, WETH/USDC). The example showcases this behaviour well with the default configuration.

Next Steps

This guide showcases everything you need to implement Range Orders on your own, but only demonstrates creating a Take Profit order in token0 to token1 direction.

Consider implementing Buy Limit orders as described in the Range Orders concept page.

This is currently the last guide in the v3-sdk series. Consider joining the Uniswap Discord or checkout the official GitHub to learn more about the Uniswap Protocol.